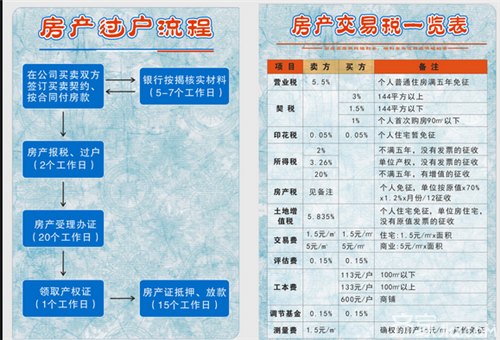

The transfer of real estate permits is a problem that many homeowners will encounter. However, many people do not know that they need those procedures. They run around and waste a lot of time and are not ready to complete. They are time-consuming and laborious. It is not clear that it does not matter, then, Xiao Bian will tell you about the transfer fees for real estate . What is a real estate transfer Transfer of real estate refers to the property ownership change procedures handled by the Housing Rights Registration Center through the transfer, purchase, sale, inheritance, and inheritance of property. That is, the entire process of transfer of property rights from Party A to Party B. There are several different situations in real estate ownership transfer, such as inherited real estate transfer, gifted real estate transfer, and second-hand house transfer. First, buyers should pay taxes 1. Deed tax: 1.5% of the housing payment (3% for an area of ​​144 square meters or more, an area of ​​90 square meters or less and 1% for the first suite) 2. Stamp tax: 0.05% of the room rate Recommended reading: How to calculate the stamp duty 3, transaction fee: 3 yuan / square meter 4, survey and mapping fees: 1.36 yuan / square meter 5, ownership registration fees and forensics fees: The general situation is within 200 yuan. Second, sellers should pay taxes 1, stamp tax: 0.05% of the housing funds 2, transaction fee: 3 yuan / square meter 3. Business tax: 5.5% of the total amount (less than 5 years of real estate license) 4. Individual income tax: 20% of the profitable part of the real estate transaction or 1% of the housing payment (if the real estate certificate is 5 years old and the only housing can be exempted) III. Taxes and fees required for transfer of commercial auction houses 1, the contract price of 3% deed tax 2. Processing fee: 5 yuan/m2 transaction fee, 550 yuan/set registration fee; 3. Stamp duty with a total price of five-tenths of a transaction; 4, the difference between 30% -60% of land value-added tax; 5. The difference of 5.55% business tax and surcharge; 6, 20% difference in personal income tax. four. How to calculate the inherited house transfer fee Let's give an example to illustrate that it is more convenient for our friends to understand. If there is a Mr. Lee, he wants to transfer his real estate to his ex-wife and his daughter. The value of his real estate is estimated at RMB 500,000. Then, how much transfer fee is required to successfully inherit the real estate transfer to Mr. Li’s daughter? Total real estate price (ten thousand yuan) Progressive billing rate Total real estate price (ten thousand yuan): 100 or less (including 100), progressive billing rate ‰: 5 Total real estate price (ten thousand yuan): 101 or more to 1,000 parts, progressive billing rate ‰: 2.5 Total real estate price (ten thousand yuan): more than 1001 to 2,000 parts, progressive charge rate ‰: 1.5 Total real estate price (10,000 yuan): From 2001 to 5,000, progressive billing rate ‰: 0.8 Total real estate price (ten thousand yuan): More than 5001 to 8000 parts, progressive charge rate ‰: 0.4 Total real estate price (ten thousand yuan): 8001 or more to 10,000 parts, progressive billing rate ‰: 0.2 Total real estate price (ten thousand yuan): more than 10,000 parts, progressive billing rate ‰: 0.1 According to the calculation formula of the real estate evaluation fee, Mr. Li’s house needs to pay an assessment fee of 5‰, which is 500,000×5‰=2500元. After the assessment, the country will inherit the assessment based on the assessed property price. Real estate transfer procedures, which are tax laws involved, cannot be avoided. The real inheritance of real estate transfer has begun, and then how much money to pay? This includes a 100 yuan registration fee, 5 yuan stamp duty stamp, inherited housing evaluation price of 0.05% of the contract stamp duty. In addition, it is still far from enough. The heir still needs notarization, and the notarization fee is as high as 6,000 yuan. In Mr. Li’s case, after spending a total of the inherited property transfer process, the required cost is 2500+100+5+250+6000=8855 yuan, which is still a considerable number. Summary: The above is a detailed introduction to the real estate transfer fees and hopes to help everyone. Cost Decoration Cost Budget House Transfer Real Estate Agent Convenience Store Renovation Cost Gutter Machine,Sheet Metal Roller,Mine W Profile Roll Former,Small Roll Forming Machine Xinxiang Tianfeng Machinery Manufacture Co., Ltd. , https://www.frollforming.de